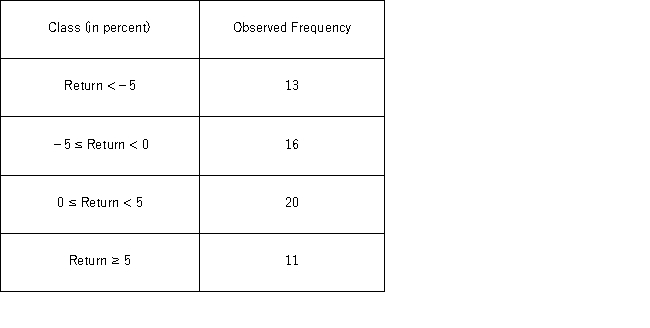

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.The expected frequency for the class 0 ≤ Return < 5 if the return is normally distributed is _______.

Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.The expected frequency for the class 0 ≤ Return < 5 if the return is normally distributed is _______.

Definitions:

Variable Manufacturing Overhead

Costs of manufacturing that change with production volume, such as utilities or indirect materials, not fixed over the short term.

Machine-Hours

A measure used in manufacturing to allocate costs to products or job orders based on the number of hours a machine is used.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead costs to products, calculated before the production period begins.

Variable Manufacturing Overhead

The portion of variable overhead costs that are directly associated with the manufacturing process, including costs like indirect materials and utilities.

Q2: A university has six colleges and takes

Q6: Tukey's HSD method uses _ instead of

Q8: Which of the following is the correct

Q26: Psychology students want to determine if there

Q30: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q59: Assume you ran a multiple regression to

Q79: Annual growth rates for individual firms in

Q95: The alternative hypothesis typically agrees with the

Q102: A machine that is programmed to package

Q131: A company has developed a new diet