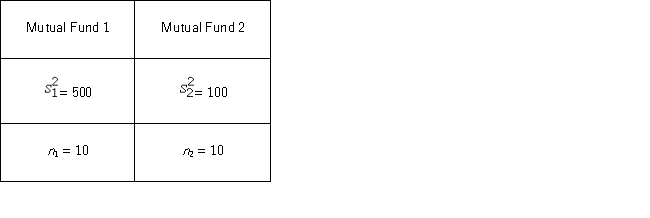

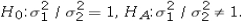

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data?

At α = 0.10,is the analyst's claim supported by the data?

Definitions:

Consumer-Directed

A model or approach that allows consumers to make decisions about the goods or services they receive, often seen in healthcare or marketing.

Health Plans

Insurance policies or arrangements that provide coverage for medical expenses to individuals or groups.

Pension Program

A retirement plan offered by an employer that provides a regular income to employees after they retire.

Paid Vacation

A period of time, often legally mandated, during which an employee is allowed to be away from work while still receiving pay.

Q22: A simple linear regression,Sales = β<sub>0</sub> +

Q37: The heights (in cm)for a random sample

Q57: A new study has found that,on average,6-

Q59: Suppose you want to determine if the

Q69: The skewness of the chi-square probability distribution

Q74: The National Center for Education would like

Q81: The student senate at a local university

Q100: An analyst conducts a hypothesis test to

Q104: A researcher analyzes the factors that may

Q108: What formula is used to calculate the