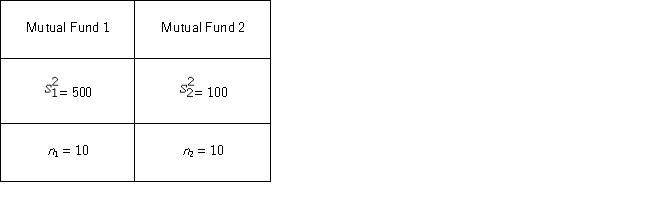

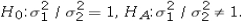

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  Which of the following is the critical F value at the 10% significance level?

Which of the following is the critical F value at the 10% significance level?

Definitions:

Equation of Exchange

An economic formula representing the relationship between the money supply, the velocity of money, the price level, and the number of transactions in an economy.

Money Supply

The entire stock of money assets in an economy at a specified period.

Velocity of Money

The rate at which money is exchanged in an economy and is used to measure the activity level of economic transactions.

Nominal Gross Domestic Product

The total market value of all finished goods and services produced within a country's borders in a specific time period, evaluated at current market prices without adjusting for inflation.

Q18: The formula for the confidence interval of

Q38: Which of the following is not a

Q39: The mortgage foreclosure crisis that preceded the

Q63: The student senate at a local university

Q65: Over the past 30 years,the sample standard

Q79: When conducting a hypothesis test,which of the

Q81: Which of the following is the formula

Q83: In a multiple regression based on 30

Q85: Which of the following identifies the range

Q100: What conditions are required by the central