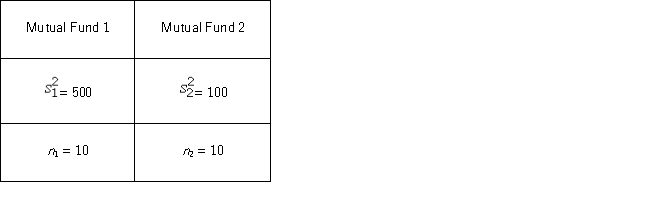

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Definitions:

DDT

A synthetic organic compound used as an insecticide, known for its environmental impacts, including the accumulation in the food chain.

Pyrethrum

A natural insecticide made from the dried flower heads of certain chrysanthemum species.

Chrysanthemums

A type of flowering plant, often grown for its brightly colored flowers and used in floral arrangements and festivals.

Carbamates

A class of chemical compounds used as insecticides, herbicides, and in some medications, known for their ability to inhibit cholinesterase enzymes.

Q6: Assume you ran a multiple regression to

Q26: When conducting a hypothesis test concerning the

Q27: In the following table,likely voters' preferences of

Q35: A manager at a local bank analyzed

Q37: Super Bowl XLVI was played between the

Q37: A sociologist wishes to study the relationship

Q38: A statistics professor at a large university

Q94: Refer to the portion of regression results

Q110: The standard deviation of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="The

Q122: The t<sub>df</sub> distribution has broader tails than