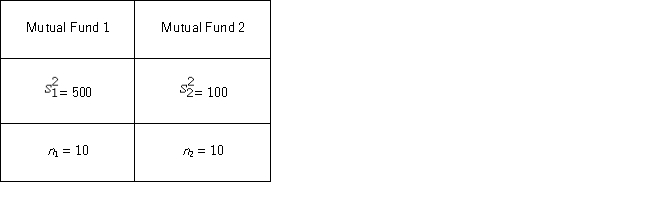

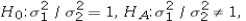

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  For the competing hypotheses

For the competing hypotheses  which of the following is the correct approximation of the p-value?

which of the following is the correct approximation of the p-value?

Definitions:

Break A Habit

The process of effectively stopping or altering a habitual behavior or pattern.

Arousal Level

The degree of physiological excitability or alertness experienced by an individual.

Acronym TOTE

A cognitive model standing for Test-Operate-Test-Exit, used to describe the process of goal-oriented behavior.

Striving For Goals

The persistent effort to achieve personal objectives and ambitions.

Q10: A sample of 1,400 American households was

Q12: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q16: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="When estimating

Q20: A farmer plants tomato seeds into four

Q67: Statistical inferences regarding σ<sup>2</sup> are based on

Q95: The chi-square test of a contingency table

Q108: The ages of MBA students at a

Q119: Vermont-based Green Mountain Coffee Roasters dominates the

Q124: Bias can occur in sampling.Bias refers to

Q125: A Type II error is made when