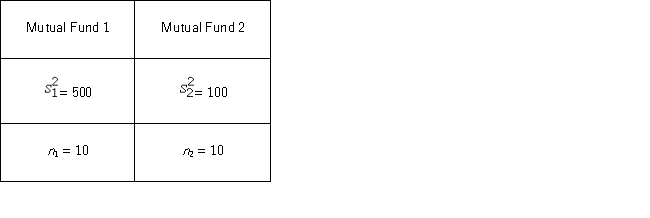

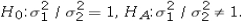

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data?

At α = 0.10,is the analyst's claim supported by the data?

Definitions:

Cycle Of Infection

A process by which an infectious agent passes from an infected host to a susceptible individual, ultimately leading to the spread of the disease.

Disinfection

The process of eliminating or reducing harmful microorganisms from inanimate objects and surfaces, excluding bacterial spores.

HBV Vaccination

Immunization against the hepatitis B virus, a major cause of liver infection, done to prevent the disease.

Medical Worker

A healthcare professional engaged in the care and treatment of patients, which includes doctors, nurses, technicians, and other healthcare staff.

Q34: The following table shows the cross-classification of

Q35: The following table shows the distribution of

Q59: The same formulas are used to compute

Q63: The following are the competing hypotheses and

Q67: What is the relationship between the standard

Q83: In a multiple regression based on 30

Q96: The sample correlation coefficient cannot equal zero.

Q110: Excel's function _ returns the p-value for

Q116: A simple linear regression of the return

Q133: A television network is deciding whether or