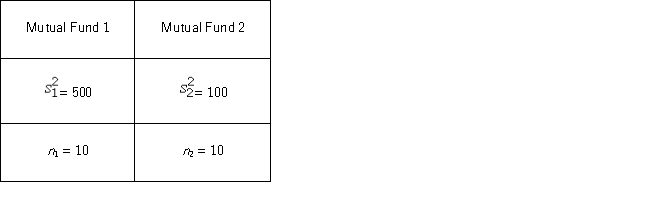

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Definitions:

Relative Purchasing Power Parity

A theory which posits that the rate of inflation in two different countries over a specific period affects the exchange rate between their two currencies.

Expected Inflation

The rate at which the general level of prices for goods and services is expected to rise, eroding purchasing power.

Euros

The official currency of the Eurozone, which is used by 19 of the 27 European Union countries.

Exchange Rate

The rate at which one currency will be exchanged for another currency.

Q2: When using Fisher's least difference (LSD)method at

Q23: The population variance is one of the

Q29: A 90% confidence interval is constructed for

Q31: An marketing analyst wants to examine the

Q56: According to a recent survey,women chat on

Q75: The numerical measure that gauges dispersion from

Q88: Compared to the sample correlation coefficient,the sample

Q89: For a given confidence level <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg"

Q114: Serial correlation is typically observed in _.<br>A)

Q118: Consider the following regression results based on