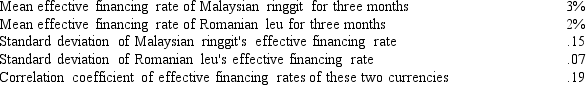

Exhibit 21-2

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

-Refer to Exhibit 21-2. What is the expected effective yield of the portfolio contemplated by Moore Corporation?

Definitions:

Annual Coupon

The interest payment made by a bond issuer to the bondholders, usually annually.

Yield To Maturity (YTM)

The rate of interest earned on a bond if it is held to maturity.

Premium

Premium in finance usually refers to the extra amount paid over the standard or nominal value, as in insurance premium payments or the additional amount to purchase securities.

Discount

A reduction applied to the nominal price of goods, services, or securities, often to incentivize purchase or investment.

Q4: The World Trade Organization (WTO) was organized

Q6: Which of the following is not an

Q14: What are the main functions of money?

Q25: The international financial crisis of 2007 was

Q37: _ refers to the purchase of financial

Q39: An American buys a Japanese car, paying

Q43: According to the text, a firm may

Q54: The discrepancy between the feasibility of a

Q54: During hyperinflation, exploding inflation causes real money

Q62: Which of the following statements is MOST