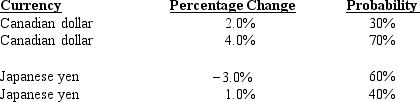

Exhibit 20-2

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥) , Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 20-2. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

Definitions:

Job Enrichment

A method used to motivate employees by giving them more responsibilities and a variety of tasks to increase their involvement in their work.

Employee Performance

Refers to the assessment and evaluation of an employee's work productivity, efficiency, and effectiveness according to predetermined standards.

Job Enrichment

This process involves improving job satisfaction by adding more meaningful tasks and duties to make the work more rewarding or interesting.

Employee Empowerment

A workplace strategy aimed at giving employees more autonomy, resources, and capability to make decisions.

Q11: _ promises to pay the beneficiary if

Q14: A letter of credit does not guarantee

Q16: The term "global" target capital structure for

Q21: Refer to above figure. If OmL1 workers

Q22: Interest rate differences between countries depend on<br>A)

Q28: Futures contracts differ from forward contracts in

Q32: Assume that there are several foreign currencies

Q38: When a foreign subsidiary is not wholly

Q39: Which of the following is not a

Q73: Discuss the effects of government deficits on