Exhibit 20-2

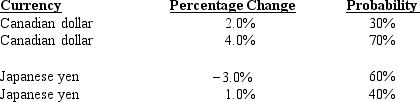

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥) , Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 20-2. What is the expected effective financing rate of the portfolio Luzar is contemplating (assume the two currencies move independently from one another) ?

Definitions:

Farm Subsidies

Government payments or other support extended to farmers to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities.

Parity Concept

The idea that year after year the sale of a specific output of a farm product should enable a farmer to purchase a constant amount of nonagricultural goods and services.

Parity Concept

A principle in economics that suggests prices, incomes, or interest rates should equalize across different markets or countries, adjusted for exchange rates.

Farm Commodities

Agricultural products such as grains, milk, cattle, fruits, and vegetables that are usually sold to processors, who use the products as inputs in creating food products.

Q8: Which of the following could explain why

Q12: The Working Capital Guarantee Program of the

Q17: A firm will likely benefit most from

Q25: A foreign target's expected future cash flows

Q41: Country risk can affect an MNC's cash

Q46: An individual's need for liquidity would increase

Q47: All types of foreign trade transactions in

Q50: How many dollars would it cost to

Q57: If the dollar interest rate is 4

Q71: The capital asset pricing theory is based