Exhibit 20-2

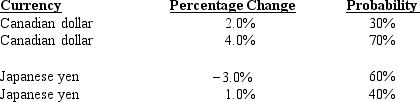

To benefit from the low correlation between the Canadian dollar (C$) and the Japanese yen (¥) , Luzar Corporation decides to borrow 50% of funds needed in Canadian dollars and the remainder in yen. The domestic financing rate for a one-year loan is 7%. The Canadian one-year interest rate is 6% and the Japanese one-year interest rate is 10%. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 20-2. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

Definitions:

Presidential Election

The process by which the president of the United States is selected, involving nationwide votes and the Electoral College system.

Southern Republicans

Republicans residing in the Southern United States, historically significant for their role during the Reconstruction era and their political evolution over time.

Territorial Government

A form of governmental authority that operates in a geographically defined territory, typically not yet a full-fledged state within a union.

Suffrage

The right to vote in public elections, a fundamental principle of democratic societies.

Q4: A currency portfolio's variability depends on the

Q22: The Shipbreakers of Alang arouse the ire

Q22: Privatization involves the sale of previously government-owned

Q27: Refer to above figure. What would be

Q29: The strongest political pressure for a trade

Q33: When using factoring to finance international trade,

Q44: Most MNCs obtain equity funding:<br>A) in foreign

Q47: Since country risk is constantly changing and

Q54: Investment is usually<br>A) more variable than consumption.<br>B)

Q71: GNP equals GDP<br>A) minus net receipts of