Exhibit 14-1 Assume That Baps Corporation Is Considering the Establishment of a of a Subsidiary

Exhibit 14-1

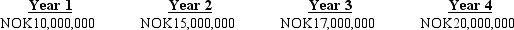

Assume that Baps Corporation is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5,000,000. If the project is undertaken, Baps would terminate the project after four years. Baps' cost of capital is 13%, and the project is of the same risk as Baps' existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

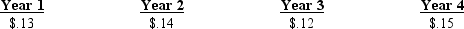

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

-Refer to Exhibit 14-1. What is the net present value of the Norwegian project?

Definitions:

Digestive Enzymes

Enzymes produced by the digestive system that break down proteins, fats, and carbohydrates into simpler molecules that can be absorbed and utilized by the body.

Esophagus

A muscular tube that conveys food and liquids from the mouth to the stomach using rhythmic contractions known as peristalsis.

Hydrochloric Acid

A strong acidic solution in the stomach that aids in digestion and the breakdown of food.

Pepsin

An enzyme in the stomach that breaks down proteins into smaller peptides.

Q12: If interest rate parity exists, transactions costs

Q14: In market-based forecasting, a forward rate quoted

Q17: Assume that a yield curve's shape is

Q29: Which of the following reflects a hedge

Q38: Which of the following is not a

Q48: In a countertrade transaction, banks on both

Q53: _ is (are) not a form of

Q57: If the foreign currency _ by the

Q65: If the foreign exchange market is _

Q88: Refer to Exhibit 10-2. What is the