Exhibit 14-1 Assume That Baps Corporation Is Considering the Establishment of a of a Subsidiary

Exhibit 14-1

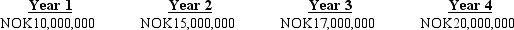

Assume that Baps Corporation is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5,000,000. If the project is undertaken, Baps would terminate the project after four years. Baps' cost of capital is 13%, and the project is of the same risk as Baps' existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

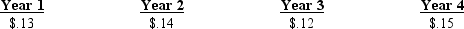

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

-Refer to Exhibit 14-1. Assume that NOK8,000,000 of the cash flow in year 4 represents the salvage value. Baps is not completely certain that the salvage value will be this amount and wishes to determine the break-even salvage value, which is $____.

Definitions:

Invitation Submit

A request to present or propose information, often in the context of a formal application or bid process.

Guitar Lessons

Instruction in playing the guitar, often focusing on techniques, chords, songs, and musical theory.

Revoke Offer

To withdraw a proposal or invitation before it has been accepted, rendering it as if the offer had never been made.

Accepting Offer

is the act of agreeing to the terms of an offer, thereby creating a contract.

Q6: If a multinational project is assessed from

Q22: In general, exchange rate fluctuations cause cash

Q40: A U.S.-based MNC has a subsidiary in

Q47: The Canadian dollar consistently appears to move

Q48: If interest rate parity exists, the attempt

Q51: According to the international Fisher effect, if

Q52: Translation exposure affects an MNC's cash flows.

Q57: Because increased external financing by a foreign

Q80: The exact cost of hedging with call

Q82: A purely domestic firm is never exposed