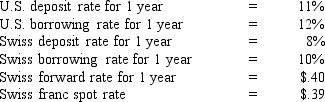

Assume the following information:  Also assume that a U.S. exporter denominates its Swiss exports in Swiss francs and expects to receive SF600,000 in 1 year.

Also assume that a U.S. exporter denominates its Swiss exports in Swiss francs and expects to receive SF600,000 in 1 year.

Using the information above, what will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a forward hedge?

Definitions:

Cash Flow Statement

A financial report that tracks the amount of cash and cash equivalents entering and leaving a company.

Amortization

The process of gradually writing off the initial cost of an asset over a period, often used for intangible assets like patents and copyrights.

Bond Discount

The difference between the face value of a bond and the price for which it sells when the selling price is lower than its face value.

Indirect Method

A cash flow statement technique that starts with net income and adjusts for changes in balance sheet accounts to arrive at operating cash flow.

Q5: Which of the following is not true

Q12: Premiums required to entice a target's board

Q26: According to the international Fisher effect (IFE):<br>A)

Q35: The _ a project's variability in cash

Q42: In an open account transaction, the exporter

Q57: Assume a U.S. firm uses a forward

Q57: Which of the following is not true

Q59: In general, a firm that concentrates on

Q63: Country differences, such as differences in the

Q99: The Fed's indirect method of intervention is