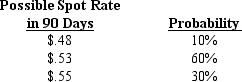

Assume that Jones Co. will need to purchase 100,000 Singapore dollars (S$) in 180 days. Today's spot rate of the S$ is $.50, and the 180-day forward rate is $.53. A call option on S$ exists, with an exercise price of $.52, a premium of $.02, and a 180-day expiration date. A put option on S$ exists, with an exercise price of $.51, a premium of $.02, and a 180-day expiration date. Jones has developed the following probability distribution for the spot rate in 180 days:  The probability that the forward hedge will result in a higher payment than the options hedge is ____ (include the amount paid for the premium when estimating the U.S. dollars required for the options hedge) .

The probability that the forward hedge will result in a higher payment than the options hedge is ____ (include the amount paid for the premium when estimating the U.S. dollars required for the options hedge) .

Definitions:

Personal Appeals

Influencing tactics that leverage the personal relationship between the influencer and the target, often invoking loyalty or friendship.

Coalition Building

The process of creating alliances among diverse groups or individuals to work toward a common goal.

Commitment

An individual's psychological attachment to an organization, idea, or relationship, typically reflected in their willingness to persist through difficulties.

Compliance

The act of conforming to or following rules, standards, or laws.

Q9: The IFE theory suggests that foreign currencies

Q16: An MNC must assess country risk not

Q17: Which of the following is the most

Q28: According to the text, an MNC's "global"

Q41: Assume that inflation in the U.S. is

Q47: Forward rates are driven by the government

Q49: Lagging refers to the delay of payment

Q69: A strong dollar is normally expected to

Q70: A forecast of a currency one year

Q87: To weaken the dollar using sterilized intervention,