The following regression model was estimated to forecast the percentage change in the Australian Dollar (AUD) : AUDt = a0 + a1INTt + a2INFt - 1 + t,

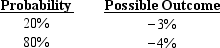

Where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a0 = .001; a1 = -.8; and a2 = .5. Assume that INFt - 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution: There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

Definitions:

Material Resources

Physical assets and tangible goods that are necessary or useful for an organization or individual to perform its activities or functions.

Intangible Knowledge

Knowledge that is not easily quantifiable or documentable, often existing in the form of skills, experiences, and organizational practices.

Stakeholder Orientation

An organizational approach that prioritizes the considerations and contributions of all stakeholders in business decision-making and strategy development.

Q1: If interest rate parity (IRP) exists, then

Q7: A primary result of the Bretton Woods

Q16: On January 1<sup>st</sup>, Madison Co. ordered raw

Q20: When a currency call option is classified

Q25: The _ the correlation in project returns

Q42: A U.S. corporation has purchased currency put

Q43: Assume that the international Fisher effect (IFE)

Q50: A currency put option is a contract

Q52: Assume the following information: You have $900,000

Q109: An option writer is the seller of