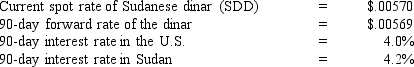

Assume the following information: You have $400,000 to invest: If you conduct covered interest arbitrage, what amount will you have after 90 days?

If you conduct covered interest arbitrage, what amount will you have after 90 days?

Definitions:

Market Value

The current price at which an asset or service can be bought or sold in an open market.

Opportunity Cost

The expense incurred from not choosing the optimal alternative available during decision-making.

College Tuition

The fee that institutions of higher education charge for enrollment and instruction.

Forgone Income

Potential earnings not received by choosing one alternative over another, often considered in opportunity cost calculations.

Q1: The overall variability of a firm's returns

Q24: MNCs can probably achieve more desirable risk-return

Q30: If the IFE theory holds, that means

Q33: If a currency's forward rate exhibits a

Q39: If a speculator expects that the Fed

Q63: A large increase in the income level

Q65: Which of the following is true?<br>A) Non-U.S.

Q70: Since earnings can affect stock prices, many

Q71: Which of the following is an example

Q72: When using _, funds are typically tied