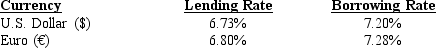

Assume the following information regarding U.S. and European annualized interest rates:  Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Definitions:

Organizational Performance

Refers to how well an organization is doing in terms of reaching its objectives, which can include financial results, customer satisfaction, and operational efficiency.

Pay Design

The strategic approach to structuring and implementing compensation formats and levels within an organization to align with business goals and employee needs.

Profit-Sharing Plan

A company program where employees receive a share of the company's profits in addition to their regular compensation.

Company's Intranet

A private network used by a company to securely share information, operational systems, or computing services only within the organization.

Q41: If interest rate parity exists, then _

Q43: A forward contract can be used to

Q48: The MNC's value depends on all of

Q61: Triangular arbitrage tends to force a relationship

Q73: Assume that an MNC has a subsidiary

Q74: Assume that the U.S. places a strict

Q75: Realignment in the exchange rates of banks

Q91: Interest rate parity (IRP) states that the

Q97: _ is not a bank characteristic important

Q117: The exchange rate mechanism (ERM) refers to