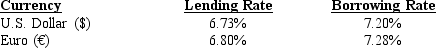

Assume the following information regarding U.S. and European annualized interest rates:  Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Definitions:

Competitive Price-searcher

A market scenario where sellers actively seek out buyers by setting prices independently to capture consumer demand.

Raise Price

The act of increasing the cost at which a good or service is sold, which can affect demand, revenue, and profit margins.

Lose Sales

The phenomenon of experiencing a reduction in the number of units sold or in total revenue.

Competitive Price-searcher

A market condition where businesses actively seek to determine the optimal pricing of their goods or services relative to their competitors to gain market share.

Q10: Many companies today are turning to Internet

Q24: Nonsterilized intervention is intervention by a central

Q28: To capitalize on high foreign interest rates

Q51: Assume no transactions costs exist for any

Q65: Technology has not yet developed the ability

Q74: The agency costs of an MNC are

Q78: Assume that the U.S. investors are benefiting

Q89: The strike price is also known as

Q103: If a government wishes to stimulate its

Q116: If foreign investors fear that a peg