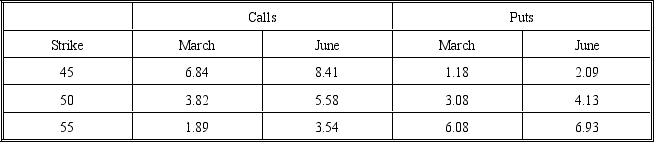

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-Suppose you closed the spread 60 days later.What will be the profit if the stock price is still at $50?

Definitions:

Vitamin D

A fat-soluble vitamin essential for calcium absorption, bone health, and immune function, produced by the body when the skin is exposed to sunlight.

Renal Pelvis

Funnel-shaped expansion of the upper end of the ureter that receives the calyces.

Renal Corpuscle

Glomerulus and Bowman’s capsule that encloses it.

Glomerulus

Mass of capillary loops at the beginning of each nephron, nearly surrounded by Bowman’s capsule.

Q3: Which of the following statements is true

Q3: Early exercise is a disadvantage in which

Q9: A range floater is a security with

Q14: A stock priced at 50 can go

Q14: Credit risk is the uncertainty of a

Q37: If the insured portfolio were dynamically hedged

Q42: Suppose that you observe a European

Q54: Legal risk is the risk that the

Q66: A political system in which political leaders

Q169: The first step in analyzing a nation's