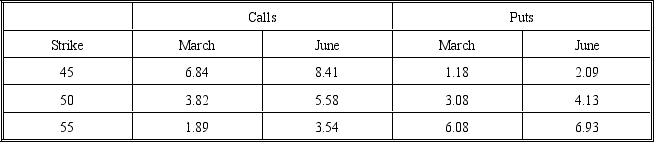

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the breakeven point?

A)$48.02

A)none of the above

B)$41.98

C)$55.66

D)$50.00

Definitions:

Clear View

A term denoting an unobstructed and clear line of sight or understanding.

Proper Objective

An aim or goal that is suitable and appropriately targeted for a specific task or endeavor.

Optical Microscopes

Instruments that use visible light and a system of lenses to magnify small objects, allowing for the observation of details not visible to the naked eye.

Physicians' Office Laboratories

Labs located within a physician's office where various tests are performed on clinical specimens to obtain information about the health of a patient.

Q6: The dividends that are subtracted from the

Q6: Which of the following is approximately the

Q11: In a weather derivative,the number of days

Q23: What is the time value of the

Q23: The futures price of a non-storable asset

Q34: The software program embedded in Hudson's figurines

Q35: The Monte Carlo simulation method of estimating

Q41: Over a large number of periods,the up

Q83: In order to generate a stable international

Q119: _ is the set of values,beliefs,rules and