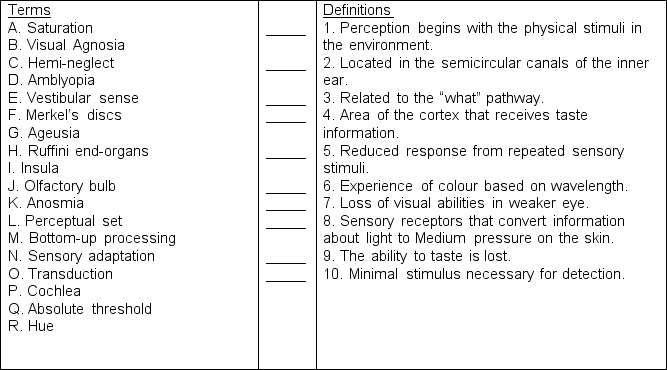

Match the appropriate words in the left column to the definitions in the right column.

Definitions:

Direct Taxes

Taxes levied directly on an individual's or organization's income or wealth.

Marginal Tax Rate

The percentage of tax levied on each additional dollar of income, representing the tax rate applicable to every tax bracket for which you're eligible.

Tax Reform Act

refers to legislation aimed at modifying the tax system. One well-known example is the Tax Reform Act of 1986 in the United States, which simplified the income tax code, broadened the tax base, and eliminated many tax shelters.

Kemp-Roth Tax Cut

A significant federal tax cut in the United States passed in 1981, aiming to stimulate economic growth through reduced individual income tax rates.

Q4: What areas of the thalamus play the

Q81: An alternative to Ainsworth's attachment theory that

Q97: Classical conditioning works with animals,but NOT humans.

Q162: The relationship between smell and memory reflects

Q171: All sensory systems send information through the

Q199: Researchers have shown that capuchin monkeys have

Q233: Which of the following drugs works by

Q233: The chemicals produced by our bodies that

Q234: Scott is using concentrative meditation to relax.What

Q395: Olivia's bird is fed treats from a