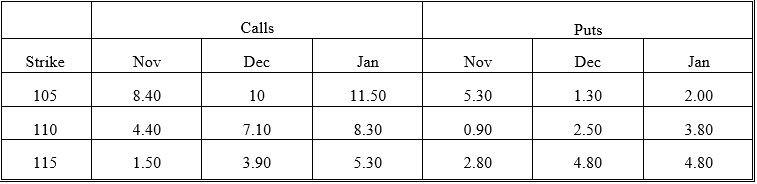

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the time value of the November 115 put?

Definitions:

Passing

The ability of a person to be regarded as a member of an identity group or category different from their own, especially in contexts of gender, race, social class, etc.

Stigma

Personal characteristics that others view as insurmountable handicaps preventing competent or morally trustworthy behavior.

Mascots

Characters, often anthropomorphic, used to represent a team, brand, or organization, typically for marketing or spirit reasons.

Consequences

Results or effects that stem from specific actions or conditions, potentially leading to positive or negative outcomes.

Q2: A PO is a security promising a

Q25: When the number of time periods in

Q30: Which of the following are not methods

Q34: Stock index arbitrage will earn,at no risk,the

Q41: The timing option will lead to early

Q44: Suppose your firm invested in a callable

Q45: A hedge portfolio is established and maintained

Q52: The options market is regulated by the

Q56: Which of the following makes the world

Q58: The Black-Scholes-Merton model for European puts,obtained