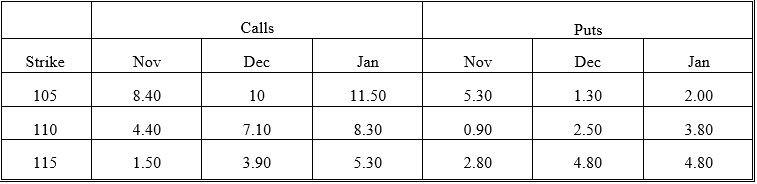

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-Suppose you knew that the January 115 options were correctly priced but suspected that the stock was mispriced.Using put-call parity,what would you expect the stock price to be? For this problem,treat the options as if they were European.

Definitions:

Critical Thinkers

Individuals who actively and skillfully analyze, assess, and reconstruct their thinking, thereby making informed decisions.

Fewest Assumptions

A principle suggesting that the simplest explanation, requiring the least speculative assumptions, is often the most accurate.

Casual Observation

An informal method of gathering data or evidence without a structured framework or hypothesis in mind.

Critical Thinking

The objective analysis and evaluation of an issue in order to form a judgment, characterized by open-mindedness, skepticism, and an analytical approach.

Q6: What is the hedge ratio if the

Q19: The appropriate fixed rate on an FRA

Q23: "Independent risk management" means which of the

Q34: Determine the appropriate price of a European

Q38: What is the profit if the position

Q43: What will be the cost of the

Q50: The implied duration of a futures contract

Q57: Which of the following statements about diff

Q59: What is the reason for executing a

Q99: Mushi Toys is an example of a(n)_.<br>A)domestic