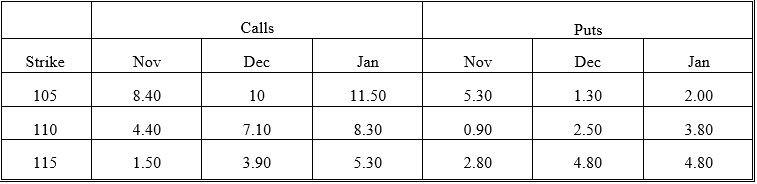

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-Suppose the stock is about to go ex-dividend in one day.The dividend will be $4.00.Which of the following calls will you consider for exercise?

Definitions:

Replacement Cost

The cost to replace an asset at its current market price, often used in insurance and accounting.

Inventory

The total amount of goods or materials a company has in stock for sale or production.

LIFO Method

Last In, First Out method; an inventory valuation method where the last items added to inventory are assumed to be sold first.

Q5: Pricing an interest rate option is a

Q7: The profit from a put bear spread

Q15: When the number of time periods in

Q29: What is the lower bound of a

Q38: The standard normal random variable used in

Q42: Forward and futures prices will be equal

Q45: A security that is sub-divided into securities

Q47: A box spread is a good strategy

Q55: Receiver swaptions allow a firm to receive

Q96: Which of the following refers to convergence