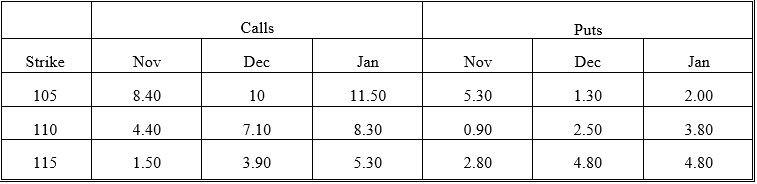

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the January 110 call?

Definitions:

Negative Affect

A psychological state involving feelings of distress, discomfort, and unhappiness.

Positive Affect

A psychological state that involves feelings of enthusiasm, pleasure, and happiness.

Hedonic Treadmill

The observed tendency of humans to quickly return to a relatively stable level of happiness despite major positive or negative events or life changes.

Facial Feedback

The hypothesis that facial expressions can influence emotional experiences, suggesting that mimicking an emotional expression can produce the corresponding emotional state.

Q2: The formula for a hedge ratio of

Q6: The dividends that are subtracted from the

Q7: Though a cross hedge has somewhat higher

Q27: Delta,gamma,and vega hedging is rather complex.Identify the

Q38: The standard normal random variable used in

Q44: Suppose your firm invested in a callable

Q58: A bank makes a $5 million 180-day

Q74: Drivers of the first age of globalization

Q102: The first age of globalization was halted

Q120: The International Monetary Fund serves each of