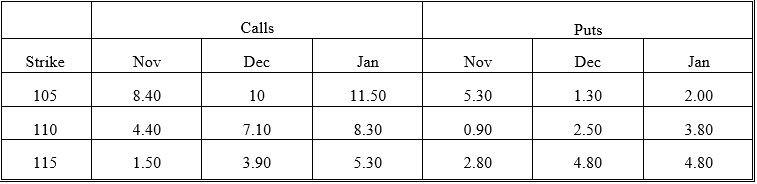

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the time value of the December 105 put?

Definitions:

Sales Tax

A tax imposed on sales of goods and services, typically calculated as a percentage of the selling price.

Tax Rate Structure

The system or design of tax rates, which can be progressive, regressive, or proportional, determining how taxes are applied based on income or other factors.

Marginal Tax Rate

The tax rate applied to the next dollar of income, indicating how much tax will be paid on an additional dollar of earnings.

Proportional

Pertaining to a relationship or situation where two quantities vary directly with each other.

Q1: A market maker is an options trader

Q2: Risk managers should report to<br>A)the chief trader<br>B)legal

Q5: Interest rate swap payments are made<br>A)on the

Q6: Currency swaps can be viewed as a

Q12: What is the profit if the stock

Q19: An order placed by an investor for

Q20: Swap payments are always either fixed or

Q22: Suppose the number of days between two

Q24: The put-call parity rule for American options

Q43: Consider the following statement related to buying