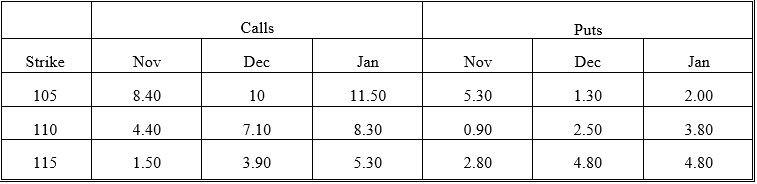

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the European lower bound of the December 105 call?

Definitions:

Contract Rate

The agreed-upon rate for interest or currency exchange in a financial contract between parties.

Market Rate

The prevailing interest rate available in the marketplace for loans or deposits of a specific maturity.

Contractual Interest Rate

The interest rate specified in a loan agreement or bond indenture.

Issued Discount

A reduction from the nominal or face value of a security at the time it is issued.

Q10: Suppose you knew that the January 115

Q13: To truly gain from a straddle,an investor

Q19: At the beginning of the life of

Q30: In the Black-Scholes-Merton model,stock prices are assumed

Q33: The price of a put on the

Q38: What is the profit if the position

Q40: To reach breakeven on a call purchase

Q46: What is the intrinsic value of the

Q54: What is the European lower bound of

Q56: Which of the following statements about mortgage-backed