Macroeconomists who study the determinants of per capita income (the "wealth of nations")have been particularly interested in finding evidence on conditional convergence in the countries of the world.Finding such a result would imply that all countries would end up with the same per capita income once other variables such as saving and population growth rates,education,government policies,etc. ,took on the same value.Unconditional convergence,on the other hand,does not control for these additional variables.

(a)The results of the regression for 104 countries was as follows,  = 0.019 - 0.0006 × RelProd60,R2= 0.00007,SER = 0.016

= 0.019 - 0.0006 × RelProd60,R2= 0.00007,SER = 0.016

(0.004)(0.0073),

where g6090 is the average annual growth rate of GDP per worker for the 1960-1990 sample period,and RelProd60 is GDP per worker relative to the United States in 1960.

For the 24 OECD countries in the sample,the output is  = 0.048 - 0.0404 RelProd60,R2 = 0.82,SER = 0.0046

= 0.048 - 0.0404 RelProd60,R2 = 0.82,SER = 0.0046

(0.004)(0.0063)

Interpret the results and point out the difference with regard to unconditional convergence.

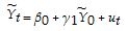

(b)The "beta-convergence" regressions in (a)are of the following type,  = β0 + β0 ln Yi,0 + ui,t,

= β0 + β0 ln Yi,0 + ui,t,

where △t ln Yi,t = ln Yi,0 - ln Yi,0,and t and o refer to two time periods,i is the i-th country.

Explain why a significantly negative slope implies convergence (hence the name).

(c)The equation in (b)can be rewritten without any change in information as (ignoring the division by T)

ln Yt = β0 + γ1 ln Y0 + ut

In this form,how would you test for unconditional convergence? What would be the implication for convergence if the slope coefficient were one?

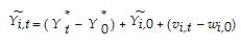

(d)Let's write the equation in (c)as follows:  and assume that the "~" variables contain measurement errors of the following type,

and assume that the "~" variables contain measurement errors of the following type,  where the "*" variables represent true,or permanent,per capita income components,while v and w are temporary or transitory components.Subtraction of the initial period from the current period then results in

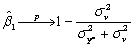

where the "*" variables represent true,or permanent,per capita income components,while v and w are temporary or transitory components.Subtraction of the initial period from the current period then results in  Ignoring,without loss of generality,the constant in the above equation,and making standard assumptions about the error term,one can show that by regressing current per capita income on a constant and the initial period per capita income,the slope behaves as follows:

Ignoring,without loss of generality,the constant in the above equation,and making standard assumptions about the error term,one can show that by regressing current per capita income on a constant and the initial period per capita income,the slope behaves as follows:  Discuss the implications for the convergence results above.

Discuss the implications for the convergence results above.

Definitions:

Creativity

The ability to generate innovative ideas and solve problems in novel ways.

Attention Span

The length of time a person can concentrate on a task without becoming distracted.

Achieve Goals

The process of setting objectives and taking steps to successfully reach or accomplish them.

Treatment Plans

Structured outlines developed by healthcare professionals detailing the therapeutic strategies and interventions for addressing a patient's specific health care needs.

Q9: CBOE option market makers are also called

Q15: Consider a swap to pay currency A

Q18: A total return swap allows substitution of

Q18: The net weight of a bag of

Q24: A delta-hedged position is one in which

Q36: A swap involving two floating rates is

Q42: In the multiple regression model with two

Q44: A currency swap with no notional amount

Q44: The kurtosis of a distribution is defined

Q50: Keynes postulated that the marginal propensity to