Assume the following model of the labor market:

Nd = β0 + β1  + u

+ u

Ns = γ0 + γ1  + v

+ v

Nd = Ns = N

where N is employment, (W/P)is the real wage in the labor market,and u and v are determinants other than the real wage which affect labor demand and labor supply (respectively).Let

E(u)= E(v)= 0;var(u)=  ;var(v)=

;var(v)=  ;cov(u,v)= 0

;cov(u,v)= 0

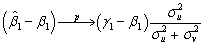

Assume that you had collected data on employment and the real wage from a random sample of observations and estimated a regression of employment on the real wage (employment being the regressand and the real wage being the regressor).It is easy but tedious to show that  > 0

> 0

since the slope of the labor supply function is positive and the slope of the labor demand function is negative.Hence,in general,you will not find the correct answer even in large samples.

a.What is this bias referred to?

b.What would the relationship between the variance of the labor supply/demand shift variable have to be for the bias to disappear?

c.Give an intuitive answer why the bias would disappear in that situation.Draw a graph to illustrate your argument.

Definitions:

Emotional Tone

Emotional tone refers to the overall mood or emotional quality of a communication, situation, or experience, influencing how it is perceived.

Tempo of Activity

The speed or rate at which an action or task is conducted.

Schachter's Two-factor

A theory of emotion that states emotions are composed of two factors: physiological arousal and cognitive label, both of which are necessary to experience emotion.

James-Lange Theory

A theory of emotion suggesting that emotions occur as a result of physiological reactions to events.

Q11: Consider the following two models to explain

Q21: An interest rate put option gives the

Q30: Risk management in which risks such as

Q34: Under the least squares assumptions (zero conditional

Q45: A joint hypothesis that is linear in

Q47: Consider the following regression line: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2833/.jpg"

Q49: Since it states that systematic risk cannot

Q50: Earnings functions attempt to predict the log

Q51: Metalgesellschaft lost about $1.3 billion doing what?<br>A)hedging

Q65: In a multiple regression framework,the slope coefficient