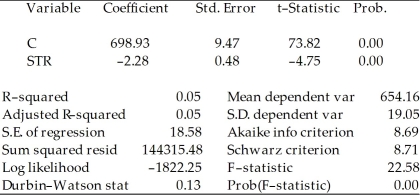

You are presented with the following output from a regression package,which reproduces the regression results of testscores on the student-teacher ratio from your textbook

Dependent Variable: TESTSCR

Method: Least Squares

Date: 07/30/06 Time: 17:44

Sample: 1 420

Included observations: 420  Std.Error are homoskedasticity only standard errors.

Std.Error are homoskedasticity only standard errors.

a)What is the relationship between the t-statistic on the student-teacher ratio coefficient and the F-statistic?

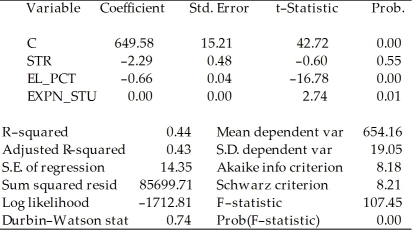

b)Next,two explanatory variables,the percent of English learners (EL_PCT)and expenditures per student (EXPN_STU)are added.The output is listed as below.What is the relationship between the three t-statistics for the slopes and the homoskedasticity-only F-statistic now?

Dependent Variable: TESTSCR

Method: Least Squares

Date: 07/30/06 Time: 17:55

Sample: 1 420

Included observations: 420

Definitions:

Delta

In finance, it's a ratio that compares the change in the price of an asset, usually a marketable security, to the corresponding change in the price of its derivative.

Underlying Asset

The financial asset upon which a derivative's price, such as an option or future, is based.

Net Requirements

The total demand for a product or component minus the inventory already on hand or on order, used in manufacturing and inventory management.

Gross Requirements

The total amount of materials or components needed to fulfill production or sales orders, before considering inventory on hand or scheduled receipts.

Q9: The settlement period in a swap refers

Q11: The duration of the futures contract used

Q13: Find the approximate market value of a

Q20: Your textbook states that under certain restrictive

Q27: Interest-only strips lose the some or all

Q28: If the absolute value of your calculated

Q38: The value of an FRA is obtained

Q40: The Black-Scholes model is not appropriate for

Q54: In the presence of heteroskedasticity,and assuming that

Q58: A bank makes a $5 million 180-day