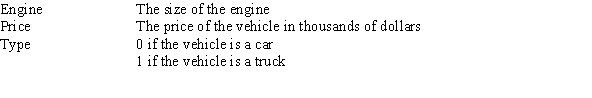

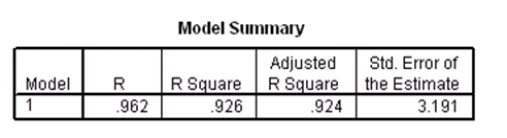

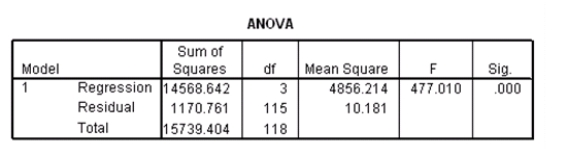

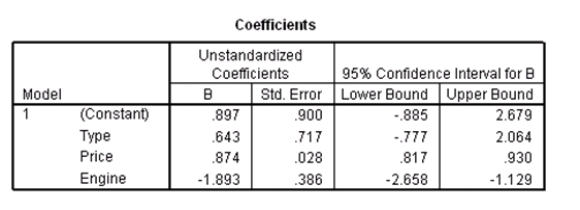

Researchers at a car resale company are trying to build a model to predict a car's 4-year resale value (in thousands of dollars)from several predictor variables.The variables they selected are as below.  Data were collected on cars of different models made by different manufacturers.SPSS output for the least-squares regression model is given below.

Data were collected on cars of different models made by different manufacturers.SPSS output for the least-squares regression model is given below.

An F test for the two coefficients of type and engine is performed.The hypotheses areH0: 1 = 3 = 0 versus Ha: at least one of the j is not 0.The F statistic for this test is 12.21 with 2 and 115 degrees of freedom.Do we reject the null hypothesis at the 5% significance level?

An F test for the two coefficients of type and engine is performed.The hypotheses areH0: 1 = 3 = 0 versus Ha: at least one of the j is not 0.The F statistic for this test is 12.21 with 2 and 115 degrees of freedom.Do we reject the null hypothesis at the 5% significance level?

Definitions:

Total Return

A comprehensive measure that reflects the actual rate of return of an investment or a portfolio over a specific time period, including both capital gains and dividends.

Risk Premium

The extra return above the risk-free rate that investors require as compensation for the risk of investing in a risky asset.

Small Stocks

Shares of companies with a smaller market capitalization, often considered more volatile but with potential for high returns.

Q13: The first day of class,the Professor collects

Q19: Does giving an incentive really work on

Q19: Suppose the proportion of students in a

Q36: Twelve people,who suffer from chronic fatigue syndrome,volunteer

Q40: The Insurance Institute for Highway Safety publishes

Q45: Data were obtained in a study of

Q51: Why is statistical control necessary?<br>A)If a process

Q76: Suppose you are testing the null hypothesis

Q92: How have classical conditioning procedures been used

Q94: Which of the following is an example