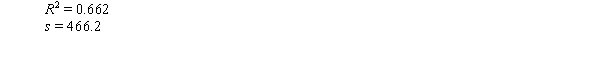

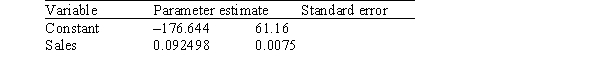

A random sample of 79 companies from the Forbes 500 list (which actually consists of nearly 800 companies) was selected,and the relationship between sales (in hundreds of thousands of dollars) and profits (in hundreds of thousands of dollars) was investigated by regression.The following results were obtained from statistical software.

The following (partial) ANOVA table was obtained from statistical software.

The following (partial) ANOVA table was obtained from statistical software.  What is the value of the F statistic for testing the hypotheses H0: 1 = 0 versus Ha: 1 0?

What is the value of the F statistic for testing the hypotheses H0: 1 = 0 versus Ha: 1 0?

Definitions:

WACC

The Weighted Average Cost of Capital represents a method for determining a company's capital cost, with each type of capital being weighted according to its proportion.

Cost of Retained Earnings

The opportunity cost to shareholders for having a company retain earnings instead of paying them out as dividends.

Flotation Costs

Expenses incurred by a company in issuing new securities, including legal, administrative, and underwriting fees.

Constant Rate

A fixed percentage or value that does not change over a specified period of time, often used in financial formulas to calculate growth or decay.

Q4: Which of the control charts is in

Q20: In this experiment,the risk-taking propensity of 90

Q22: Sometimes a person learns to respond to

Q24: In both latent learning and social-cognitive learning,what

Q81: The 68-95-99.7 rule tells us that if

Q88: What must be paired together for classical

Q100: An experiment finds that a certain male

Q148: After watching her teenage sister put on

Q182: Which two learning processes seem to be

Q197: During operant learning,the tendency for an organism