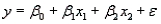

Suppose a regression analysis based on the model  with 15 observations produced SSE = 3.55,

with 15 observations produced SSE = 3.55,  = 13.131, and

= 13.131, and  = 125.1. In this case, what is the proportion of the total variability in y that is accounted for by

= 125.1. In this case, what is the proportion of the total variability in y that is accounted for by  and

and  ?

?

Definitions:

Earned Income Credit

The Earned Income Credit (EIC or EITC) is a refundable tax credit for low- to moderate-income working individuals and families, particularly those with children, to reduce the amount of tax owed and potentially return a portion of their earned income.

Disqualified Income

Types of income that cannot be considered or used for certain applications or benefits, as defined by specific rules or guidelines.

Dividends

Payments made by a corporation to its shareholder members, representing a portion of the corporate profits.

American Opportunity Tax Credit

A credit for qualified education expenses paid for an eligible student for the first four years of higher education, with the potential to receive a partial refund if the credit is more than the taxpayer owes.

Q6: When the independent variables are correlated with

Q34: Refer to Sunshine and Skin Cancer Narrative.

Q50: Refer to Wind Velocity and Windmills Narrative.

Q59: Six points have these coordinates: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4962/.jpg"

Q85: Refer to Attitude Test Narrative. Determine the

Q85: To be valid, a chi-square test of

Q92: The Wilcoxon signed-rank test is applied to

Q108: If you wish to test the usefulness

Q135: Refer to Correlation between Shoreline Erosion and

Q157: Having a large number of predictors in