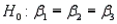

In testing the significance of a multiple regression model in which there are three independent variables, the null hypothesis is  .

.

Definitions:

Price Appreciation

An increase in the market value of an asset over time, often influenced by factors such as demand, inflation, and market conditions.

Risky Securities

Financial instruments that carry a high degree of investment risk due to the potential for significant fluctuations in value.

Riskless Securities

Financial instruments that are considered to have minimal risk of loss, typically issued by governments.

Risk Premium

The additional return expected by an investor for holding a riskier asset compared to a risk-free asset.

Q2: Refer to SAT Scores and GPA Narrative.

Q7: Refer to Laundry Detergent Preference Narrative. Develop

Q15: Multicollinearity is present when there is a

Q22: Apply the Friedman test to the accompany

Q41: Which of the techniques listed below are

Q49: Consider the following two independent samples: <img

Q63: Refer to Sales and Experience Narrative. Determine

Q85: Refer to Attitude Test Narrative. Determine the

Q111: A travel agency primarily reserves flights

Q210: The <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4962/.jpg" alt="The value