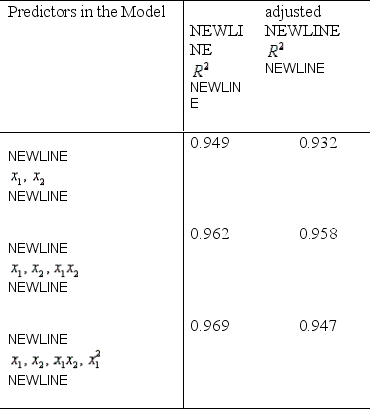

Suppose you have a choice of three multiple linear regression models. Listed below are the independent variables (predictors) and the values of  and adjusted

and adjusted  for each model.

for each model.  Which model would you choose as the most appropriate to use? Justify your answer.

Which model would you choose as the most appropriate to use? Justify your answer.

Definitions:

Deferred Income Tax Asset

A balance sheet item that represents taxes paid or carried forward but not yet realized on the income statement.

Net Operating Loss

The deficit that occurs when a business's expenses exceed its revenues, excluding taxes and certain other expenses, over a fiscal period.

Future Profitability

An estimation or outlook on the capacity of a business to generate earnings in future periods, often considered for investments or strategy planning.

Deferred Tax Asset

A tax amount that is paid or carried forward, representing future tax savings due to overpayment or advance payment of taxes, or due to allowable temporary differences.

Q12: Refer to Blacktop statement. What is the

Q13: Which of the following values may be

Q22: A firm has been accused of engaging

Q28: The following table shows the results of

Q32: The first step in a Wilcoxon rank

Q58: A two-sample t test with independent samples

Q70: Refer to College Textbook Sales Narrative. Calculate

Q80: In a simple linear regression model, the

Q94: A multiple regression model has the form

Q113: In order to predict with 99% confidence