Life Expectancy Narrative

An actuary wanted to develop a model to predict how long individuals will live. After consulting a number of physicians, she collected the age at death (y), the average number of hours of exercise per week (  ), the cholesterol level (

), the cholesterol level (  ), and the number of points that the individual's blood pressure exceeded the recommended value (

), and the number of points that the individual's blood pressure exceeded the recommended value (  ). A random sample of 40 individuals was selected. The computer output of the multiple regression model is shown below.

). A random sample of 40 individuals was selected. The computer output of the multiple regression model is shown below.

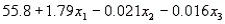

The regression equation is

S = 9.47 R-Sq = 22.5%

S = 9.47 R-Sq = 22.5%

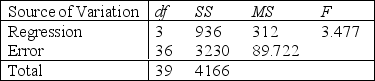

Analysis of Variance

-Refer to Life Expectancy Narrative. Interpret the coefficient  .

.

Definitions:

Federal Income Tax

The tax levied by the U.S. federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

State Unemployment Tax

A tax that employers are required to pay to their state government to fund unemployment benefits for workers who have lost their jobs.

Payroll Tax Expense

This refers to the taxes that an employer is responsible for paying on behalf of its employees, which generally include social security and Medicare taxes.

FICA Taxes Payable

Taxes owed by an employer, employee, or both, to the Federal Insurance Contributions Act for Social Security and Medicare.

Q6: The data that result from two binomial

Q17: Refer to Product Markup Narrative. What are

Q54: Which of the following is a measure

Q55: Refer to College Textbook Sales Narrative. Do

Q81: Refer to Absenteeism Narrative. State the null

Q91: Refer to Sales and Experience Narrative. Predict

Q97: Refer to Vending Machines Narrative. Estimate <img

Q110: Refer to Air Pollution Monitors Narrative. Does

Q165: Refer to Correlation between Shoreline Erosion and

Q221: The adjusted value of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4962/.jpg" alt="The