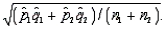

Assume that two independent random samples of sizes  and

and  have been selected from binomial populations with parameters

have been selected from binomial populations with parameters  and

and  , respectively. The standard error of the sampling distribution of

, respectively. The standard error of the sampling distribution of  (the difference between the sample proportions) can be estimated by

(the difference between the sample proportions) can be estimated by

Definitions:

Additional Revenue

Income generated from activities not related to the primary operation of the business.

Straight-Line Depreciation

A scheme for disbursing the expenditure of a physical property over its operational lifespan in equivalent annual quotas.

Capital Budgeting

The process of evaluating, comparing, and selecting the best projects to invest in to maximize a firm’s value, considering long-term investments.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity and operational efficiency of the business.

Q23: Refer to Tennis Magazine Narrative. Calculate the

Q28: When formulating a hypothesis test, the null

Q40: Refer to Online Time Usage Narrative. If

Q41: Refer to Swimming Average Narrative. Perform

Q74: The Student's t distribution is used to

Q87: Refer to Medical School Completion Narrative.

Q134: The possible observations of continuous random variables

Q153: Continuous random variables that can assume values

Q224: Refer to Examination Times Narrative. What is

Q232: Refer to Canada Revenue Agency Audits Narrative.