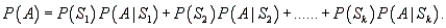

Given a set of events  that are mutually exclusive and exhaustive and an event A, the law of total probability states that P(A) can be expressed as

that are mutually exclusive and exhaustive and an event A, the law of total probability states that P(A) can be expressed as

Definitions:

Effective Federal Tax Rate

The average rate at which an individual or a corporation is taxed by the federal government, calculated by dividing the total tax paid by taxable income.

Tax-Deferred Retirement

Investment accounts, like 401(k)s or IRAs, that allow earnings to grow tax-free until funds are withdrawn, usually during retirement.

Flexible Spending Account

A type of savings account, usually for healthcare or dependent care expenses, that offers tax advantages by using pre-tax dollars.

Federal Taxes

Federal Taxes are imposed by the government on income, goods, services, and activities, used to fund public services and government operations.

Q8: Refer to the Legislation Poll table. Which

Q24: There are only two possible outcomes in

Q30: If a store manager selected a sample

Q33: In the long run, real GDP is

Q62: A television set manufacturer has found the

Q78: A continuous quantitative variable is one that

Q80: A relative frequency distribution describes the proportion

Q107: Refer to Defective Bolts Narrative. Find E(x).

Q134: Which of the following CANNOT generate a

Q176: Let x be a binomial random variable