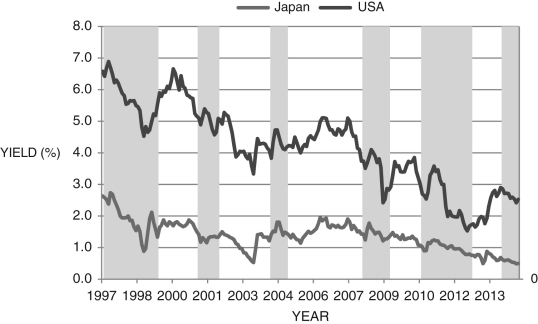

Figure 18.4 below shows bond yields on U.S., Japanese, and German 10-year bonds, 1997-2014. The gray shaded areas represent Japanese recession dates. During this period the U.S. had two official recessions: one in 2001 and one from 2008-2009. Given this information and what you know about Japanese and American debt-to-GDP ratios, explain the reason(s) for the differences in Japanese and American bond yields.Figure 18.4: Japan and USA 10-Year Bond Yields and Japanese Recession Dates: 1997-2014

Definitions:

Dextrose

A simple sugar and a form of glucose that is often used in medical settings as an intravenous energy source.

Sodium Chloride

Commonly known as table salt, it is an ionic compound with the chemical formula NaCl, essential for life in small quantities.

Potassium Supplement

A dietary supplement used to increase potassium intake, important for nerve function, muscle control, and blood pressure regulation.

Packed Red Blood Cells (RBCs)

Concentrated red blood cells separated from plasma, used for transfusions to treat anemia or blood loss.

Q22: Standards of living in the long run

Q23: With a nominal price rigidity, firms cannot

Q32: According to the Congressional Budget Office report

Q37: The consumer chooses his or her _

Q43: The source(s) of funds for the government

Q45: In the short run, the real exchange

Q46: To identify an asset bubble, economists and

Q58: "DSGE" stands for:<br>A) dynamic stochastic general equilibrium.<br>B)

Q82: France, Italy, Germany, the United Kingdom, and

Q104: Sovereign debt is issued by:<br>A) the IMF.<br>B)