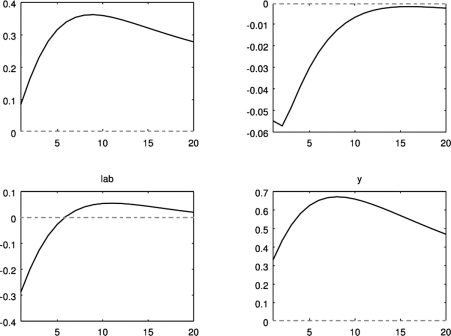

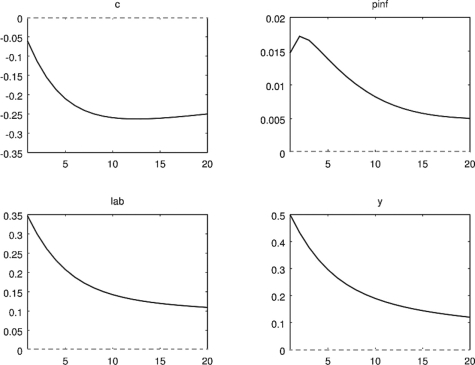

Consider the impulse response functions generated using the Smets and Wouters (2007) DSGE model, in response to a shock to productivity (TFP) and government expenditures as shown in Figures 15.8 and 15.9. The endogenous variables are consumption (c), inflation (pinf), labor supply (lab), and GDP (y). Briefly discuss the results of the simulations using macroeconomic theory.

Figure 15.8: Impulse Response Function to a Change in Productivity

Figure 15.9: Impulse Response Function to a Change in Government Spending

Definitions:

Parent Entity

A business that controls one or more subsidiary companies.

Deferred Tax Asset

A financial item on a company's balance sheet that reduces future tax liabilities due to deductible temporary differences, losses, or credits.

Unrealised Profit

Profit that results from an increase in value of an asset that has not yet been sold and thus has not generated actual cash inflow.

Intragroup Sale

Transactions occurring between entities within the same group or conglomerate, often scrutinized for transfer pricing and tax implications.

Q11: The national income identity can be rearranged

Q41: The economic meaning of the intertemporal budget

Q44: Banks that are deemed too big to

Q81: According to the Fisher equation, the real

Q82: According to data in the text, which

Q100: Your uncle asks you to explain stock

Q105: Moral hazard in the banking system can

Q107: Which of the following describes the consumption

Q110: The effect of the subprime loan crisis

Q111: In perfect competition, firms hire workers until