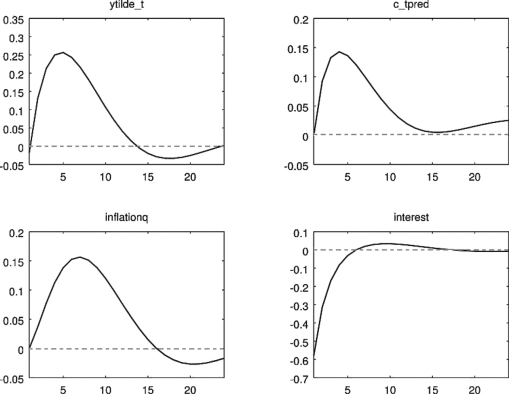

Consider the impulse response functions generated using the Altiga, Christiano, Eichenbaum, and Lindé (2011) DSGE model in response to a monetary shock. The endogenous variables are the output gap (ytilde_t), consumption (c_tpred), inflation (inflationq), and the interest rate (interest). Briefly discuss the results of the simulations, using macroeconomic theory.

Figure 15.10: Impulse Response Function to a Change in Money Supply

Definitions:

P/E Ratio

The price-to-earnings ratio, a valuation metric that compares the current share price of a company to its per-share earnings, used to evaluate if a stock is over or undervalued.

Dividend Payout Ratio

A financial metric that measures the percentage of a company's earnings paid out to shareholders as dividends.

Earnings Per Share

Earnings per share (EPS) is a company's profit divided by the outstanding shares of its common stock, indicating the company's profitability on a per-share basis.

Share Price

The present cost for purchasing or selling a single unit of a corporation's stock.

Q9: _ reduced loans despite the Fed's attempts

Q33: According to the quantity theory of money,

Q51: Using the neoclassical model of consumption, an

Q62: The return to a risky asset can

Q88: The equation used to predict movements in

Q90: For any two periods, t and k,

Q93: The relatively high growth rate of money

Q102: Free labor migration is more effective at

Q106: The labor market equilibrium determines the market

Q123: What tool does the U.S. Federal Reserve