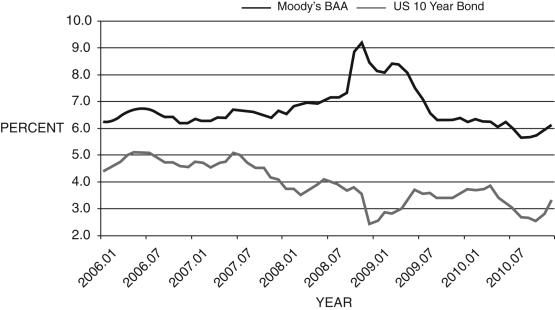

Figure 14.1: BAA and 10-Year Bonds, 2006-2010

-Consider Figure 14.1. The difference between these two curves can be interpreted as:

Definitions:

Trial Close

A sales technique involving asking a potential customer a question that assumes the sale is going to be made, in order to gauge their readiness to buy.

FAB

An acronym for Features, Advantages, and Benefits, a sales and marketing strategy focusing on the product's aspects and their value to the customer.

SELL Sequence

A structured approach in sales that typically includes steps such as Show features, Explain advantages, Lead into benefits, and Let the customer talk.

Business Proposition

An offer or plan proposed by a business to provide certain products or services with the aim of generating value or profit.

Q16: According to data in the text, which

Q19: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="If is

Q19: What declined during the Great Recession?<br>A) the

Q44: Banks that are deemed too big to

Q52: In the Phillips curve <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="In

Q63: When economists say "sticky inflation," they mean:<br>A)

Q69: When _ hold(s), if the present value

Q105: Moral hazard in the banking system can

Q110: Every six to eight weeks, or so,

Q120: Consider the yield curves in Figure 12.3.