Consider two economies with the following IS curves, denoted 1 and 2:

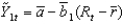

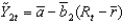

IS1:

IS2:

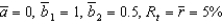

Given these two curves, the economies are identical except that they respond to interest rate changes differently. Suppose we assume

) If the real interest rate in each economy falls to

Then:

Definitions:

Manicotti

A type of pasta in the form of large tubes, usually stuffed with cheese, meat, or vegetables, and baked in a sauce.

Pasta Costs

The expenses associated with the production, distribution, and sale of pasta, including raw material (e.g., wheat), labor, and transportation costs.

Family Recipe

A recipe for a dish that has been passed down from generation to generation within a family, often considered a closely guarded secret.

Three-Martini Lunches

A colloquial term referring to a leisurely, extravagant lunch experience often associated with business discussions and networking.

Q4: Which of the following represents the AD

Q49: An increase in labor regulations results in:<br>A)

Q62: The aggregate demand (AD) curve is given

Q67: In 2009, China and India both experienced

Q71: In the Smets-Wouters DSGE model, an increase

Q78: A key reason that unemployment in the

Q90: Practically, in the long run the real

Q96: Sticky nominal wages can lead to:<br>A) involuntary

Q101: Consider Figure 12.8. You are chairman of

Q124: In the late 1990s, the United States