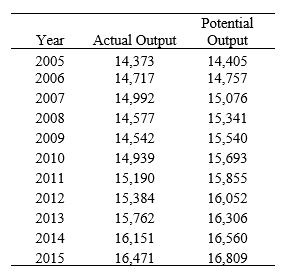

The following table shows real GDP and potential real GDP for the years 2005-2015. Refer to this table when answering the following questions.

Table 10.1 ($ billions)  (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-About how much did short-run output equal in 2009 and 2015, respectively?

Definitions:

Market Risk Premium

The additional return an investor requires from a market portfolio over the risk-free rate, compensating for the risk of the investment.

Financial Leverage

The use of borrowed funds to increase the potential return on an investment.

Shareholder Leverage

The use of borrowed funds by shareholders to increase their potential returns from an investment.

Operating Leverage

A measure of how revenue growth translates into growth in operating income due to fixed costs in a company's business model.

Q1: Consider the Phillips curve in Figure 12.4.

Q2: The idea that you value receiving $1,000

Q4: If the Federal Reserve reduces the money

Q55: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="If equals

Q63: Consider Figure 13.3. If there is a

Q76: Economists often use a rate of inflation

Q94: Which of the following financial reforms were

Q96: Unemployment due to workers shuffling from one

Q100: The Federal Reserve always has targeted interest

Q118: Consider the labor market depicted in Figure