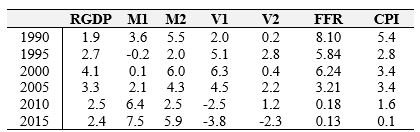

Table 8.3 contains the following variables, growth rates of real GDP, M1, M2, velocity of M1 and M2 (denoted V1 and V2), the federal funds rate (FFR), and the CPI inflation rate. Use the quantity equation to calculate the equilibrium inflation rate using individually M1 and M2. Next, calculate the equilibrium inflation rate assuming the quantity theory of money holds. According to your calculations, which is a better predictor of inflation, M1 or M2? Similarly, which is a better predictor of inflation, assuming the quantity theory holds, or not?Table 8.3: Growth Rates

(Source: FRED II, St. Louis Federal Reserve)

Definitions:

Hoovervilles

Shanty towns built by homeless people during the Great Depression in the United States, named after President Herbert Hoover, who was blamed for the economic plight that led to their conditions.

Homeless

Individuals or families lacking stable and permanent housing.

Reciprocal Trade Agreements Act

A 1934 U.S. law that allowed the president to negotiate tariff reductions with other countries to promote international trade.

American Tariffs

Taxes imposed by the United States on imported goods to protect domestic industries and generate revenue.

Q2: You are the head of the central

Q15: In a typical recession, generally only _

Q36: In the long run, the:<br>A) federal funds

Q40: Consider Table 7.1. In 2010, the unemployment

Q44: The equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="The equation

Q50: In models with perfect competition:<br>A) economic profits

Q53: According to the combined Solow-Romer model, all

Q74: For which of the following does the

Q88: In _, housing prices collapsed following a

Q112: The money demand curve slopes upward with