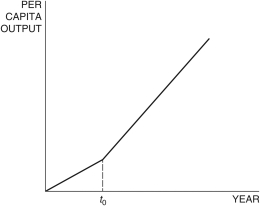

Figure 6.1: Romer Model: Per Capita Output

-In the Romer model in Figure 6.1, at time t0, a change in the growth rate of per capita output can be explained by a(n) :

Definitions:

Gross Investment

The total amount of money spent on capital goods, or assets intended to produce future income, not accounting for depreciation.

Net Investment

The total amount spent on capital assets, like buildings and machinery, minus depreciation. It reflects the increase in the value of physical assets.

Depreciation

The gradual decrease in the economic value of the capital assets of a firm or nation due to wear and tear, obsolescence, or age, often accounted for in financial statements through depreciation expense.

Disposable Income

Income available to an individual or family after taxes, which can be spent or saved.

Q2: Suppose we calculate the percent change in

Q9: The figure below shows the three-month bond

Q16: Consider the data in Table 7.2. Using

Q19: According to the Phillips curve presented in

Q33: The majority of mortgage-backed securities were held

Q47: The quote "Inflation is always and everywhere

Q85: When a firm purchases more capital, ceteris

Q89: When depositors rush to get their deposits

Q93: During the Great Recession, inflation was relatively

Q103: In the Solow model, if investment is