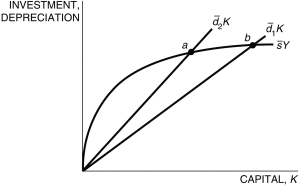

Refer to the following figure when answering the following questions.

Figure 5.5: Solow Diagram

-Figure 5.5 represents two countries, 1 and 2. Country ________ has a higher depreciation rate and, therefore, has a ________ steady state than the other country.

Definitions:

Compound Interest

Interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan.

Cash Payback Period

The length of time required for an investment to generate cash flows sufficient to recover the initial outlay.

Present Value Factors

The numerical values used to calculate the present value of future cash flows, based on a specific discount rate.

Desired Rate of Return

The minimum rate of return on an investment that an investor considers acceptable, given its risk and alternative options.

Q4: The key insight in the Solow model

Q5: Using the expenditure approach, government expenditures include:<br>A)

Q9: The figure below shows the three-month bond

Q16: In the combined Solow-Romer model, the total

Q21: The implications of the quantity theory of

Q25: In 1979, in the face of rising

Q31: Generally, during a recession:<br>A) inflation rises.<br>B) the

Q41: Consider Figure 9.5, which shows the annual

Q70: Which of the following is a nonrival

Q92: Household consumption as a share of GDP