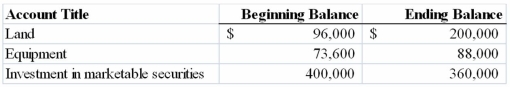

The Garcia Corporation provided the following partial list of accounts, balances and activities for 2013:  Garcia's income statement reported a $16,000 gain on sale of land that occurred when land that had cost $32,000 was sold for $48,000. The company also recorded a $20,000 loss on the sale of marketable securities. No additional marketable securities were purchased during the year. The company also sold equipment originally costing $12,000 with accumulated depreciation of $8,000 for $7,200. Purchases of additional land and equipment were cash transactions.

Garcia's income statement reported a $16,000 gain on sale of land that occurred when land that had cost $32,000 was sold for $48,000. The company also recorded a $20,000 loss on the sale of marketable securities. No additional marketable securities were purchased during the year. The company also sold equipment originally costing $12,000 with accumulated depreciation of $8,000 for $7,200. Purchases of additional land and equipment were cash transactions.

Required:

Prepare the investing activities section of the statement of cash flows.

Definitions:

Investing Section

A part of the statement of cash flows that reports the purchase and sale of long-term investments and property, plant, and equipment, reflecting how the company invests its cash.

Financing Section

Part of the cash flow statement that records cash activities related to funding the company, such as obtaining loans or issuing stock.

Statement of Cash Flows

A financial statement summarizing the total cash earnings from a company's operational activities and investments, alongside the expenses and investments paid out over a specific time frame.

Accounting Equation

A fundamental principle of accounting stating that assets equal liabilities plus owners' equity (Assets = Liabilities + Equity).

Q3: Prior to the late 1970s, the United

Q5: Creditors are primary users of financial statements.

Q11: Economic growth is defined as the percent

Q29: George Co. declared and paid a $1

Q31: Where is treasury stock reported on a

Q35: For many companies, cash flow from operating

Q58: Selected financial information for Maris Company for

Q92: Indicate whether each of the following statements

Q112: Fall River, Inc. uses the perpetual inventory

Q113: Easton Company purchased equipment that cost $55,000