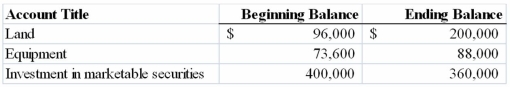

The Garcia Corporation provided the following partial list of accounts, balances and activities for 2013:  Garcia's income statement reported a $16,000 gain on sale of land that occurred when land that had cost $32,000 was sold for $48,000. The company also recorded a $20,000 loss on the sale of marketable securities. No additional marketable securities were purchased during the year. The company also sold equipment originally costing $12,000 with accumulated depreciation of $8,000 for $7,200. Purchases of additional land and equipment were cash transactions.

Garcia's income statement reported a $16,000 gain on sale of land that occurred when land that had cost $32,000 was sold for $48,000. The company also recorded a $20,000 loss on the sale of marketable securities. No additional marketable securities were purchased during the year. The company also sold equipment originally costing $12,000 with accumulated depreciation of $8,000 for $7,200. Purchases of additional land and equipment were cash transactions.

Required:

Prepare the investing activities section of the statement of cash flows.

Definitions:

Pectoralis Major

A large muscle in the upper chest that aids in the movement of the shoulder joint, including flexion, rotation, and adduction of the arm.

Coracobrachialis

A muscle in the shoulder that assists in flexing and adducting the arm.

Tuberosity

A large rounded projection on a bone, often serving as an attachment point for muscles and ligaments.

Brachioradialis

A muscle of the forearm that flexes the forearm at the elbow, especially when the forearm is in a position midway between pronation and supination.

Q5: Using the expenditure approach, government expenditures include:<br>A)

Q64: On December 31, 2013, Fairmont Corporation had

Q66: In September of 2013, Houston Company issued

Q73: Recognizing depreciation expense on equipment or a

Q73: Which of the following is a claims

Q74: The costs of economic growth include which

Q115: Under what condition should a pending lawsuit

Q119: For 2013, the Warner Corporation had beginning

Q143: An impairment of an intangible asset reduces

Q154: Which of the following answers shows the